Why Gratitude?

Client-Centric from the Start. Solutions in Your Best Interest.

For some retirement is far off on the horizon; for others it is imminent; and never in the history of our country has that time had less to do with age and more to do with how you manage your wealth than today.

There’s a better way to build and protect your wealth than the traditional method. You can protect and build wealth while at the same time avoiding the impacts of rising taxes and market volatility.

Our combination of personalized wealth management and access to a broad range of investment strategies has provided our clients with the best overall solutions to fit their specific needs.

Schedule A Call

Schedule your complimentary wealth protection/tax reduction conversation today.

about Us

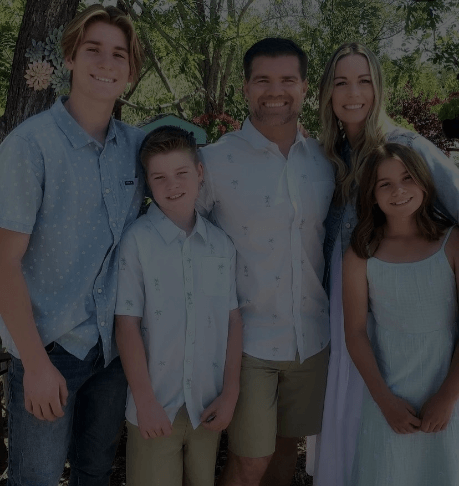

When we launched our careers in 1999–Patrick in education, and Amie in the building industry, like many of the clients we now help, we did not see the curving career paths that would lead us to here. But with a love of helping others and for crunching numbers, we found ourselves intrigued by financial services and how we could help others navigate the often murky waters of retirement planning.

When it comes to retirement planning, the Gratitude Mission is to serve financial peace of mind with gratitude–go figure:-)–clarity and compassion. We listen to our clients’ needs and ambitions, and we tap into our team of expert advisors, tax specialists, and estate planners to create an Individualized Retirement Plan to best suit our clients’ aspirations. When you work with the Gratitude team, you can count on straightforward help preserving a safe retirement income that will last your lifetime, lowering your tax burden throughout retirement, and mitigating the risk of a long-term care event draining your nest egg prematurely. We also specialize in estate planning, life insurance, premium financing, and key person executive bonus plans for businesses.

At the end of the day, in whatever way we may be able to serve you, what you should know about us is that we love helping people. And we do that by listening with curiosity, generosity, and gratitude. Our expertise and wide array of financial products and strategies have a proven track record of helping others achieve financial freedom and successfully retire without having to dramatically change their lifestyle or pay a hefty tax bill each year. But none of that matters if we don’t listen and understand your needs first. This is where we shine. Schedule your complimentary wealth protection/tax reduction conversation today. to see if Gratitude is a good fit for you.

Retirement Confusion We

Can Help Clarify

Retirement Confusion We Can Help Clarify

- Market Volatility: Can I mitigate market crashes and still have the opportunity for growth in my portfolio?

- Inflation: How to maintain your purchasing power in retirement, despite rising inflation.

- Taxes in retirement: what impact will the sunset of the Tax Cuts and Jobs Act have on your retirement?

- Three Eroding Forces on Your Retirement Savings: Taxes, Healthcare, & Inflation

- Retirement Red Zone: How to survive this crucial time. What do you need to prepare?

- Social Security: When is the right time to start taking Social Security without potentially missing out on tens of thousands in benefits?

- Mitigating Risk: The BIG mistake most Americans are making with their retirement accounts…Are you one of them?

- Retirement Income: Will you have enough? Learn strategies to help generate guaranteed income for life.

- Retirement Income: How to create a sustainable retirement income plan that includes replacing a spouse’s lost income or Social Security.

Schedule A Call

Schedule your complimentary 15-minute introductory call today.

FAQs

Thinking about what will bring you the most happiness is key to getting the most out of the next big chapter in your life. Discovering your retirement personality can reveal your “more” and lead you to financial solutions, like annuities, that can help you retire your way.

- Looking for leisure

- Pursuing a passion

- Giving back with service

- Starting a second act

- Focused on family

- Seeking adventure

Take our retirement personality quiz to discover where your retirement

priorities lie and what could bring you greater joy.

Take our retirement personality quiz to discover where your retirement priorities lie and what could bring you greater joy.

- My perfect day looks like: Relaxing – enjoying coffee and reading / Volunteering – helping and serving others / Working – staying busy with work tasks / Family – spending time with loved ones / Traveling – seeing the world / Outdoors – enjoying nature and outdoor activities / Other – please explain (fill in the blank)

- While browsing a bookstore, I linger in: The magazine rack – I like to be up-to-date on trends and current events / The personal interest section – I like thumbing through beautiful images and helpful how-tos about my favorite pastime / The children’s section – I love reading to my grandkids / The travel guides section – My thirst for new scenery has no end / The social sciences or biographies – Reading real-world accounts of others inspires me / The fiction section – There’s nothing more relaxing than taking a break from reality

- When it comes to money in retirement: I don’t mind tightening my belt a bit – as long as I don’t have to work anymore / I want to have enough to be able to leave money for my family / I need to have enough discretionary income to pursue my passion projects / I plan to make more with my new career / I would like to have enough to donate to the charities that I support / I plan to spend on travel

- When exploring a new town, my first stop is: A food truck to sample a regional specialty / The farmer’s market to support small businesses / An outdoor cafe where I can soak up local life / Main Street to browse for souvenirs for the grandkids / The antique store to add to my collection / The visitor’s center to get a feel for what’s hot in the area / Spending time with Mother Nature on an outdoor adventure or visiting a natural landmark

- I hope to share my retirement with: My spouse or significant other / A friend who shares my sense of adventure / My family / Others who share my same interests / Those involved in my new business venture / Like-minded people who are as devoted to volunteering as I am

- I am happiest when I’m: Doing something creative / Just relaxing and there;s nowhere I have to be / Exploring a new place / Hanging out with family & friendsIf / Volunteering at my favorite charity / Involved in work I consider fulfilling If I found $100 in the pocket of my coat, I would: Think about buying the newest smartphone / Treat my family to lunch / Go to dinner and a movie / Drop it in the church’s offering basket / Upgrade the garden tools in my potting shed / Save it for an upcoming vacation / Buy my grandkid the latest toy they’ve been wanting

- In retirement, I’m most looking forward to: Developing skills that I’ve always wanted to learn / Having adventures while I travel / Beginning a new career / Being part of special moments with my family / Exploring interests I never had time for while working / Helping others

- 1. My perfect day looks like: Relaxing - enjoying coffee and reading / Volunteering - helping and serving others / Working - staying busy with work tasks / Family - spending time with loved ones / Traveling - seeing the world / Outdoors - enjoying nature and outdoor activities / Other - please explain (fill in the blank)

- 2.While browsing a bookstore, I linger in: The magazine rack - I like to be up-to-date on trends and current events / The personal interest section - I like thumbing through beautiful images and helpful how-tos about my favorite pastime / The children’s section - I love reading to my grandkids / The travel guides section - My thirst for new scenery has no end / The social sciences or biographies - Reading real-world accounts of others inspires me / The fiction section - There’s nothing more relaxing than taking a break from reality

- 3.When it comes to money in retirement: I don’t mind tightening my belt a bit - as long as I don’t have to work anymore / I want to have enough to be able to leave money for my family / I need to have enough discretionary income to pursue my passion projects / I plan to make more with my new career / I would like to have enough to donate to the charities that I support / I plan to spend on travel

- 4.When exploring a new town, my first stop is: A food truck to sample a regional specialty / The farmer’s market to support small businesses / An outdoor cafe where I can soak up local life / Main Street to browse for souvenirs for the grandkids / The antique store to add to my collection / The visitor’s center to get a feel for what’s hot in the area / Spending time with Mother Nature on an outdoor adventure or visiting a natural landmark

- 5.I hope to share my retirement with: My spouse or significant other / A friend who shares my sense of adventure / My family / Others who share my same interests / Those involved in my new business venture / Like-minded people who are as devoted to volunteering as I am

- 6.I am happiest when I’m: Doing something creative / Just relaxing and there;s nowhere I have to be / Exploring a new place / Hanging out with family & friendsIf / Volunteering at my favorite charity / Involved in work I consider fulfilling

- 7.If I found $100 in the pocket of my coat, I would: Think about buying the newest smartphone / Treat my family to lunch / Go to dinner and a movie / Drop it in the church’s offering basket / Upgrade the garden tools in my potting shed / Save it for an upcoming vacation / Buy my grandkid the latest toy they’ve been wanting

- 8.In retirement, I’m most looking forward to: Developing skills that I’ve always wanted to learn / Having adventures while I travel / Beginning a new career / Being part of special moments with my family / Exploring interests I never had time for while working / Helping others

newsletter

Stay updated with our latest newsletter release.

Schedule A Call

Schedule your complimentary wealth protection/tax reduction conversation today.

On a Mission

We’re on a mission to help people create and protect their retirements from the impact of rising taxes and the death of the 60/40 stock-bond retirement ratio.

The current plan, whether 401(k), 403(b), TSP, or pension will soon be rife with taxes, and is already getting hammered by market volatility. If you want to sleep at night without worry, and do the best you can to avoid returning after your organization has thrown you a farewell party, schedule a free call with us to see if we’re a good fit for you. It’s not that stocks, bonds, or the 401(k) are inherently bad. They’re not. It’s just that the financial industry has led 401(k) and IRA owners to become over-reliant on the market to determine whether they will or will not be able to retire on time, without much thought of impending taxes or the sequence of returns at the time of retirement.

If you would like a blueprint for a guaranteed, tax-free income stream built to last for the long run, schedule a call with us today. We’ll outline a proactive asset-shifting strategy to shield you from risk in order to maximize returns.

newsletter

Stay updated with our latest newsletter release.

Schedule A Call

Schedule your complimentary wealth protection/tax reduction conversation today.

Retirement Personality

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Aliquam blandit volutpat velit, quis porttitor velit elementum sed. Duis non iaculis est, et viverra est. Duis eget pharetra risus. Donec non scelerisque neque, sit amet pharetra turpis. Orci varius natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Cras blandit luctus sollicitudin. Ut malesuada scelerisque orci in lacinia. Orci varius natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus.

Sed pretium, odio ac tincidunt tincidunt, elit urna luctus metus, eu porta ipsum velit vitae arcu. Mauris euismod nibh libero. Praesent egestas felis sed varius consectetur. Suspendisse quis orci a mauris pharetra tincidunt eu facilisis nulla. In laoreet neque id nunc imperdiet efficitur.

How Much Do I Need to Retire?

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Aliquam blandit volutpat velit, quis porttitor velit elementum sed. Duis non iaculis est, et viverra est. Duis eget pharetra risus. Donec non scelerisque neque, sit amet pharetra turpis. Orci varius natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Cras blandit luctus sollicitudin. Ut malesuada scelerisque orci in lacinia. Orci varius natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus.

Sed pretium, odio ac tincidunt tincidunt, elit urna luctus metus, eu porta ipsum velit vitae arcu. Mauris euismod nibh libero. Praesent egestas felis sed varius consectetur. Suspendisse quis orci a mauris pharetra tincidunt eu facilisis nulla. In laoreet neque id nunc imperdiet efficitur.

Schedule A Call

Schedule your complimentary wealth protection/tax reduction conversation today.

Contact Us

Let us help you plan the life you want to retire to. Connect with your Gratitude Financial Professional. Don’t have one? Contact us

Contact Details

- 2385 Camino Vida Roble STE 200, Carlsbad, CA 92011